Overview

In this post, I will explain how you can survive a bear market and how to cope and prepare for the next bull market cycle. The bear market is the most brutal period for most people in crypto. I say most people because you can make money in any market.

The preparation for a Bear Market starts from a bull market, even as far back as the previous bear market. You leverage on previous experience and learn.

TL;DR Learn to take profits in a bull market. Bet on builders and invest in utility projects. DYOR and DCA. Zoom out, take a break, and touch the grass.

Hold on For Dear Life - HODL

Imagine growing your portfolio from zero to a hundred thousand dollars to watch everything go belly up. You will need to hold on for your dear life.

HODL is a misspelling of HOLD, which means holding on to your coins and tokens during volatile market movement. There is a lot of speculation about the crypto market and Bitcoin price, and the general sentiment is that Bitcoin will be worth upwards of $100k in a few years. This makes holding seem the best thing to do in the long run. Don't get me wrong, I'm not asking you to hold on to your tokens.

The Best Strategy?

Many people go into the crypto market without a strategy other than HODLING. This is fine in a bull cycle, but what happens in more nuanced situations? You find HODL isn't nearly enough as you watch everything seemingly go to zero. But in these scenarios, many HODL memes ask you to Diamondhand.

In my opinion, HODL and Diamond Handing are terms popularized by whales and influencers to get you to hold on while you are being used as exit liquidity. As much as the community is an essential part of Web3 products, you must never forget you are trading items in a capitalist market where no one is a true friend.

In a bear market, the only coins worth holding are those with excellent fundamentals and use cases, products that have been tested and proven to work. HODL according to your risk appetite. And if the markets get too harsh, Hold on For Dear Life!

BUIDL

Are you building a blockchain product, or still have it in the conceptualization stage? The best time to build is during a bear market.

It is easy for projects to do well in a bull market when everyone is euphoric and a lot of money is pumped into the crypto market. It is during the bull cycle that a lot of people invest in hopes of making maximum gains.

In a bear market, people are fearful and more cautious about what they invest in. If you can pull investors during a bear, that's a good indicator of the quality of your product.

A bear market allows you to learn what people want and iterate. During a bear, people focus more on utilities, as such projects are usually filtered out, leaving products and utilities people need and use.

If your product survives a bear, it will do exceptionally well in a bull market.

Take Profits

Learn to take profits in every type of market.

As I mentioned earlier, HODL is a tool used by people who manipulate you into being exit liquidity. Many people in crypto view selling as a taboo, a shame. There is even a slur, "paper hand," for those who sell.

Be a Paperhand

Because of the volatility of the crypto market, people have become delusional about what profit means. Many traders often gun for those high percentage profits, but they don't realize these are fringe events. Not every coin or NFT will do an x100 price movement. In the stock market, a 10% profit is a lot, so why don't you take it in crypto?

If you mint an NFT or buy a token that does x2 of the initial amount invested, that is already a 100% profit. However, most people do not sell but hold on in hopes of making more. Newsflash, you will most likely end up holding a bag if you do not sell.

When faced with the dilemma of holding or selling, always ask yourself would you be happy to sell at a lesser price if the market falls? Are you willing to let go of part of the value your assets have gained? Set a price beneath which you won't be comfortable or happy selling.

If you made a huge sum of money, take profit regardless of whether the price could go up or not. There is no shame in selling, and the only money you really own is the one in fiat.

Take profits while the market is going up and down. Remember, the crypto market is speculative, profit is profit, and Fiat is king.

DCA

Dollar-Cost Averaging is a trading technique where you take a fixed amount of money and divide it into equal parts to purchase an asset over some time. DCA helps to reduce risk to you due to volatile market conditions. It can also be a great tool to help you invest long-term with little cash.

During dips, inexperienced crypto traders rush to fill their bags, thinking they bought assets at a discount, only for the market to go further down, leaving them with heavier bags. A DCA strategy would have helped them avoid the rut they fell in.

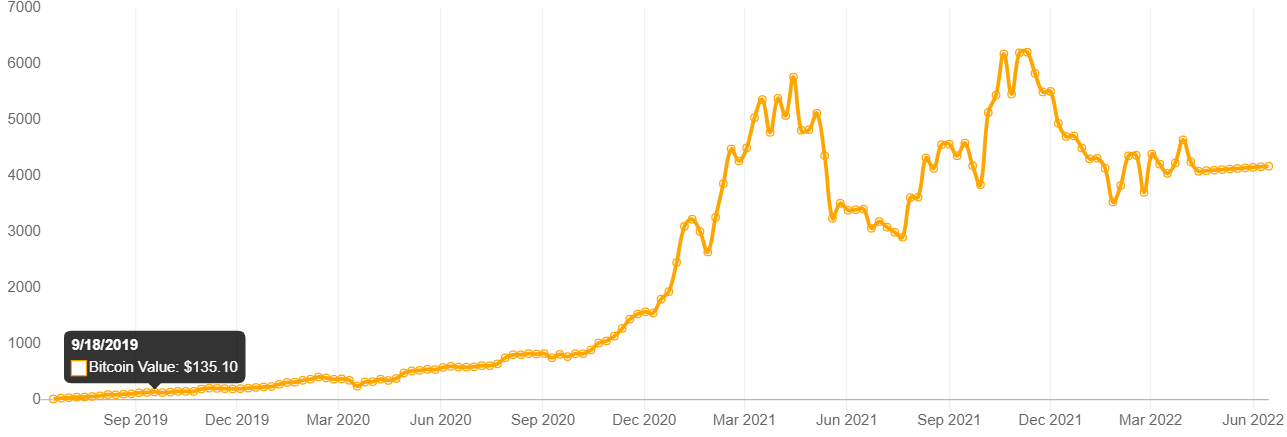

According to dcabtc.com, if you bought $10 of Bitcoin every week for the past 3 years, you would have turned $1,570 into $4,165, which is a +165% profit.

DYOR

The bear market is the best time to invest; however, be careful in what projects you are investing in. You need to Do Your Own Research. There are several metrics you can use to judge a project.

Photo by RODNAE Productions from Pexels: pexels.com/photo/wood-laptop-writing-displa..

Photo by RODNAE Productions from Pexels: pexels.com/photo/wood-laptop-writing-displa..

In a future post, we would take an in-depth look into Doing Your Own Research. However, the following can help you make a form of calculated guess:

1. Community

At the heart of successful Web3 products is community; community is essential because they are the ones who will buy and use your product. As a potential investor, you need to look at the community and try to gauge their outlook and convictions about the project. Interact with them, hear their opinions and concern, and take note of how the project team handles FUD.

However, this is not foolproof. Projects with great communities can still fail for a number of reasons, especially if they fail to deliver.

2. Utility

When investing in a coin, project, or NFT, you are essentially buying a piece of a company. So, ask yourself, what does this company offer? What tools, products, and services are they offering. As I mentioned earlier, the bear market filters out low-quality products, so if you are holding on to an expensive but low-quality product, chances are that you will get burnt.

Always bet on builders. They will most likely still be here after a cruel bear because they offer essential services and valuable products.

3. Team

The success of a project heavily depends on the team; how competent are they and do they have a proven track record? It may be hard to evaluate the team given the nature of anonymity in Web3. However, a lot of great builders are doxxed; a team with good intentions shouldn't be afraid to dox. This is not to say that anonymous builders are nefarious in nature, quite the contrary because a lot of Web3 products are built by anonymous people or entities operating with pseudonyms.

Zoom Out

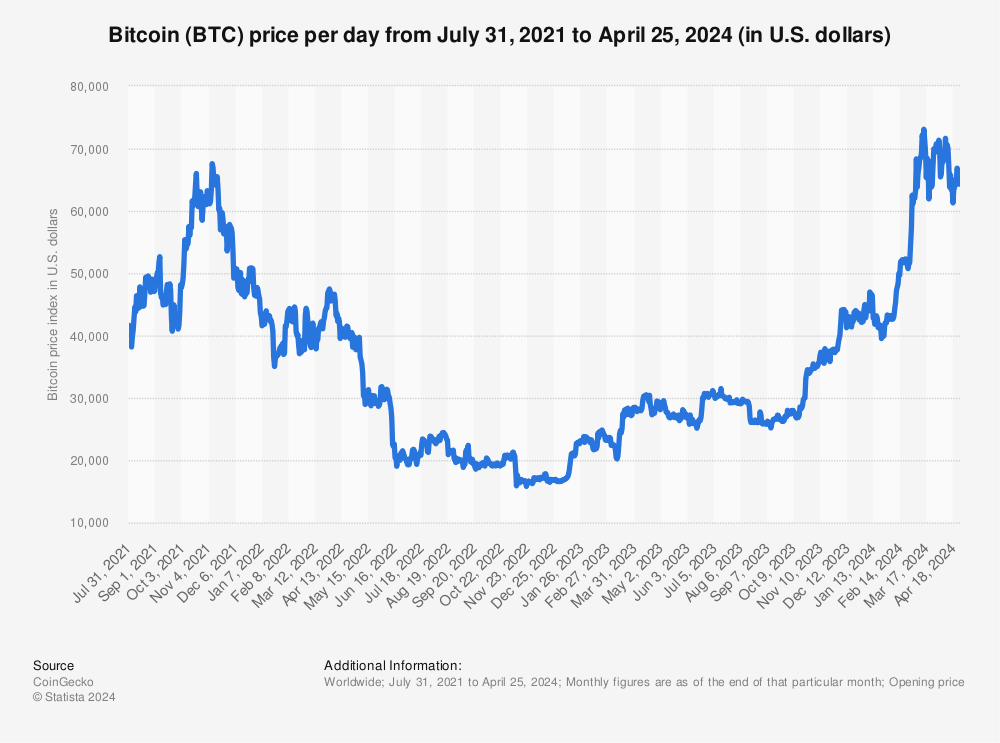

We often fail to see the big picture when looking at charts and price movements of our crypto assets. Bitcoin is in a better place than it was two years ago and in a far better place 10 years back.

Find more statistics at Statista

Bitcoin and, by extension, the crypto market has been steadily growing, hitting a $2 trillion market cap in 2021. In contrast with the $121.94 Global Domestic Equity Market capitalization.

Invest Only What You are Willing to Lose

Preparation for a bear starts in a bull market. You don't want to invest all your life's savings because it could all get wiped out in harsh market conditions, and if you are lucky, you could lose a small percentage.

This brings us to DCA and taking profits, which I mentioned earlier. You can only survive a bear if you already took profits in a bull cycle. This profit can be used to DCA into solid projects during a bear, and you could use that money to buy a house or pay your bills. The U.S. Securities and Exchange Commission has tips to help you invest wisely.

Go Outside and Touch Grass

The bear market can be brutal on your mental health, so stop looking at the charts, go outside and touch the grass. That's the best thing you can do in certain situations. Just ignore everything and come back during the next bull cycle, and get plenty of exercise.

WAGMI!